Community-Powered Savings

Have you ever wished there was a way to save money that felt more personal and community-oriented than just putting cash in a traditional bank account? Enter the world of ROSCAs – a time-tested financial tool that's been helping people achieve their financial goals for generations.

🎯 What Is a ROSCA? Understanding the Basics

A ROSCA (Rotating Savings and Credit Association) is a group of people who agree to contribute a fixed amount of money regularly to a shared pot. Each member takes turns receiving the full pot.

📊 How a ROSCA Works - Example

🌟 Real-World Example: Tsewang's Story

Success Story

🌍 The Cultural Significance and Global Reach

Nepal

Mexico

China

India

West Africa

Korea

This widespread presence across cultures speaks to the universal appeal and effectiveness of community-based saving systems. For many immigrants in America, ROSCAs provide a familiar and trusted way to save money while maintaining cultural connections.

💰 Benefits of Joining a ROSCA

💵 Financial

- ✅ No interest or bank fees

- ✅ Forced savings discipline

- ✅ No credit checks needed

- ✅ Early access to funds

🤝 Community

- 🔗 Strong social connections

- 🔗 Mutual accountability

- 🔗 Shared knowledge

- 🔗 Trust building

🌏 Cultural

- 🎭 Traditional practices

- 🎭 Cultural connections

- 🎭 Bridge old & new

- 🎭 Community identity

⚠️ Important Considerations Before Joining a ROSCA

🔐 Trust and Security

- • Only join with trusted people

- • Verify stable income sources

- • Create written agreements

- • Keep detailed records

📋 Legal and Planning

- • Trust-based, not legal contracts

- • Budget for all contributions

- • Consider rotation position

- • Have emergency backup plans

📋 Tips for ROSCA Success

1 Start Small

- • Begin with a smaller group and contribution amount

- • Get to know potential members before committing

- • Build trust gradually

2 Set Clear Rules

- • Establish payment dates and collection methods

- • Agree on how rotation order will be determined

- • Create guidelines for handling missed payments

- • Define what happens if someone leaves the group

3 Stay Organized

- • Keep detailed records of all transactions

- • Use digital payment apps for easier tracking

- • Schedule regular check-ins with group members

- • Maintain open communication about any concerns

Moving Forward with ROSCAs in America

While ROSCAs might be different from traditional American banking, they represent a valuable alternative for building financial security and community connections. As you consider whether a ROSCA is right for you, remember that it's not about choosing between traditional banking and ROSCAs – many successful savers use both to achieve their financial goals.

Questions to Ask Before Joining

Self-Assessment Checklist

- Do I have a stable income to make regular contributions?

- Do I know and trust the other members?

- What are my savings goals and timeline?

- Am I comfortable with the commitment level required?

Your Next Steps

💡 Getting Started

Ready to explore ROSCAs as part of your financial strategy? Start by:

- Discussing the concept with trusted friends or community members

- Setting clear savings goals for yourself

- Researching successful ROSCA groups in your community

- Creating a budget to ensure you can make consistent contributions

Remember, financial success often comes from combining traditional methods with community-based approaches like ROSCAs. What matters most is finding the right mix of tools that works for your unique situation and goals.

Share your experience with community-based saving methods in the comments below! We'd love to hear your thoughts and questions.

Related Reading

Explore more articles that complement this topic:

- Dhukuti: Nepal's Traditional Savings Circles — Discover the Nepali version of ROSCA and its rich cultural history.

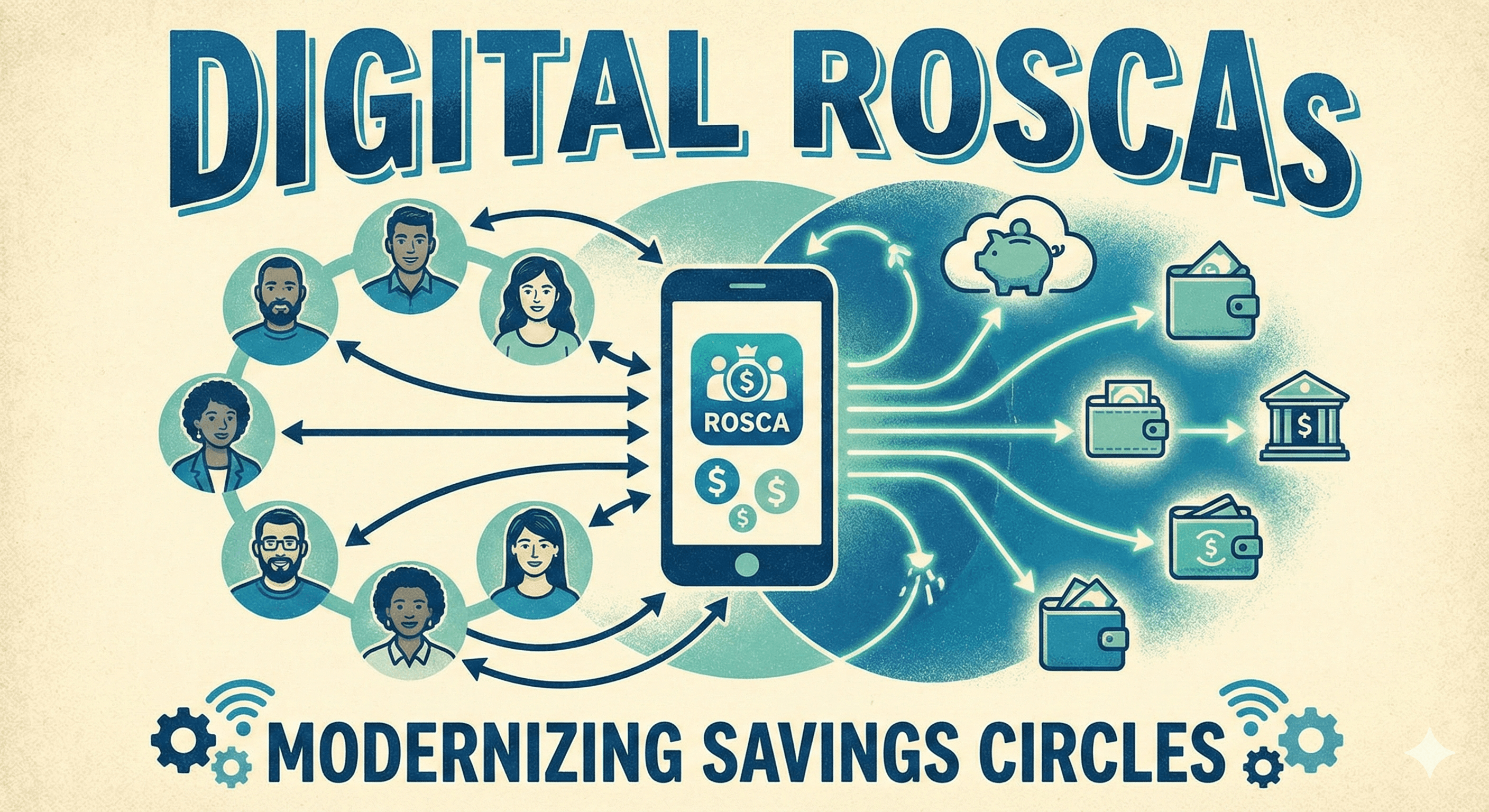

- The Digital Evolution of Community Savings — See how technology is transforming traditional savings circles.

- Building Credit in America — Complement your ROSCA savings with a strong credit history.